Motorcycles and scooters are now a big part of our lives, giving us an easy and fast way to get around.

But, while riding is fun, it’s also important to make sure we stay safe and financially secure. That’s where Two Wheeler Insurance comes in. In this guide, we’ll look closely at Two Wheeler Insurance, covering everything from the different types to picking the right coverage and clearing up some common misunderstandings.

In Simple Word -Two-wheeler insurance is like a safety shield for your bike. It helps pay for fixing your bike if it gets accidentally damaged. And it doesn’t stop there; it also gives you money protection if something bad happens, like your bike getting stolen, damaged by nature, or vandalized. Plus, it covers you if your bike causes trouble for someone else

Table Content: -

Introduction

- Importance of Two Wheeler Insurance

- Overview of the Blog

Why Two Wheeler Insurance Matters

- Protection against Accidents

- Legal Requirements

Financial Security

Types of Two Wheeler Insurance

- Third-Party Insurance

- 2 Comprehensive Insurance

Factors Affecting Premiums

- Vehicle Type

- Age of the Vehicle

- Insured Declared Value (IDV)

How to Choose the Right Coverage?

- Assessing Personal Needs

- Understanding Policy Terms

Common Myths about Two Wheeler Insurance

- “I don’t need insurance; I’m a safe rider.”

- “Third-party insurance is sufficient.”

Tips to Save on Premiums

- No Claim Bonus (NCB

- 2Installing Safety Devices

The Claims Process

- Filing a Claim

- Documentation Required

Future Trends in Two Wheeler Insurance

- Digitalization of Processes

- Customized Policies

Customer Testimonials

- Real-life Stories of Insurance Beneficiaries

The Role of Insurance in Road Safety

- Promoting Responsible Riding

- 2Impact on Accident Rates

The Evolution of Two Wheeler Insurance

- Historical Perspective

- Technological Advancements

Importance of Reading the Fine Print

- Understanding Exclusions

- Hidden Clauses

Comparing Insurance Providers

- Factors to Consider

- Online Reviews and Ratings

Summary

- Recap of Key Points

Encouragement to - Secure Two Wheeler Insurance

Why Two Wheeler Insurance Matters

Protection against Accidents

Riding a bike or scooter has its own dangers. Accidents might occur, and having insurance makes sure you’re financially safe if something bad happens.

Legal Requirements

In lots of areas, you need to have at least third-party insurance by law. Knowing the legal stuff helps you follow the rules and steer clear of fines.

Financial Security

Two Wheeler Insurance provides a safety net for your finances. From covering repair costs to medical expenses, it acts as a financial cushion when you need it the most.

Types of Two Wheeler Insurance

Third-Party Insurance

This type of insurance covers damages and injuries caused to third parties. It’s a basic requirement and the minimum coverage needed in many regions.

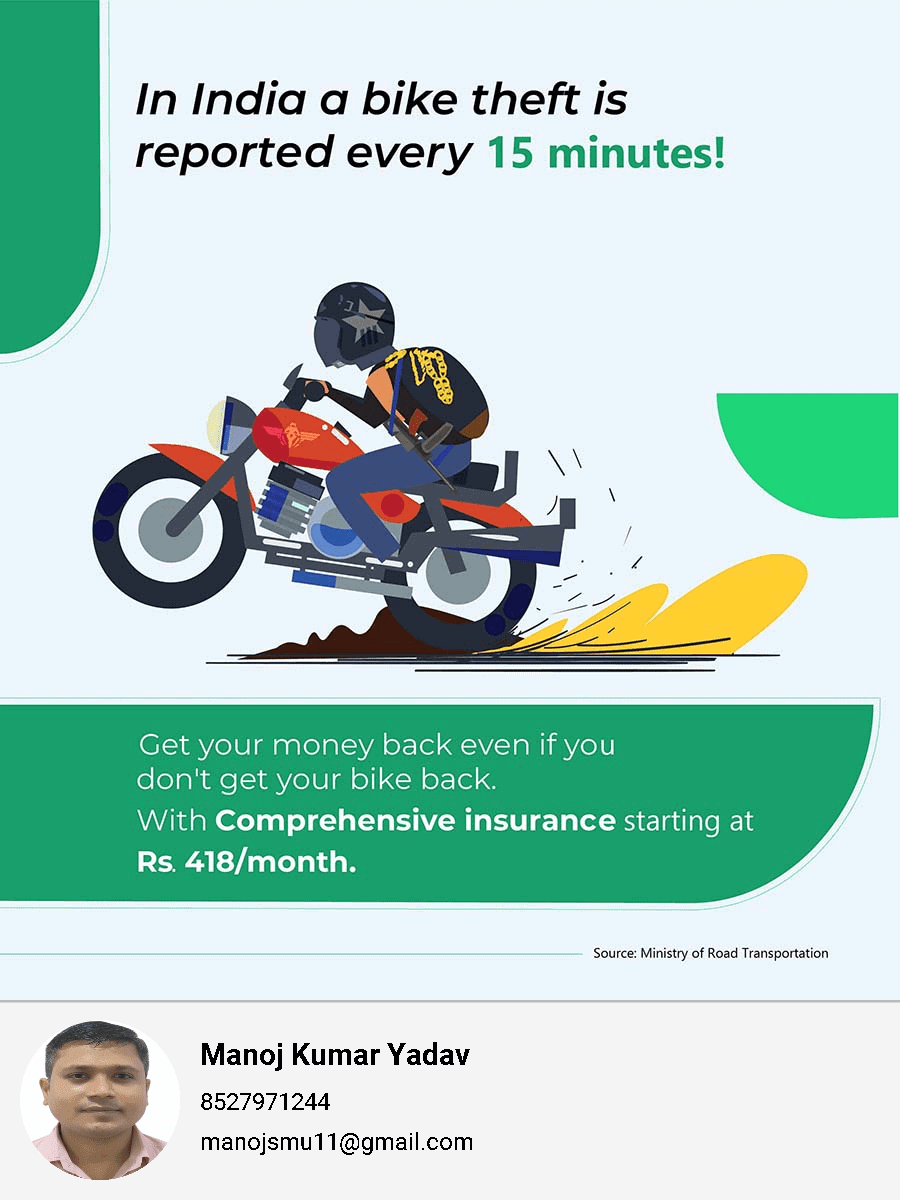

Comprehensive Insurance

For a more extensive coverage, comprehensive insurance is the way to go. It covers damages to your vehicle as well as third-party liabilities.

Factors Affecting Premiums

Vehicle Type

The type of two-wheeler you own significantly influences your insurance premium. High-end bikes may have higher premiums due to their repair costs.

Age of the Vehicle

Older vehicles might have lower premiums, but it’s crucial to balance this with the potential repair costs.

Insured Declared Value (IDV)

IDV is the maximum amount your insurer will pay in case of total loss or theft. Choosing the right IDV affects your premium.

How to Choose the Right Coverage?

Assessing Personal Needs

Consider your usage patterns, riding habits, and the area you live in. This helps in determining the coverage that suits you best.

Understanding Policy Terms

Reading and understanding the terms of your policy prevents surprises when you need to make a claim. Don’t hesitate to seek clarifications.

Common Myths about Two Wheeler Insurance

“I don’t need insurance; I’m a safe rider.”

Even the safest riders can face unforeseen circumstances. Insurance is a safety net for everyone.

"Third-party insurance is sufficient."

While it’s a legal requirement, comprehensive insurance provides broader coverage, ensuring better protection.

Tips to Save on Premiums

No Claim Bonus (NCB

Safe riding and avoiding claims earn you NCB, leading to discounts on your premiums.

Installing Safety Devices

Adding security features to your two-wheeler not only enhances safety but also reduces insurance premiums.

The Claims Process

Filing a Claim

Understanding the step-by-step process of filing a claim ensures a smooth experience during stressful times.

Documentation Required

Having the necessary documents in order expedites the claims process. Know what you need in advance.

Future Trends in Two Wheeler Insurance

Digitalization of Processes

The insurance industry is evolving digitally, making processes more convenient for policyholders.

Customized Policies

Tailored insurance policies are becoming more prevalent, allowing individuals to choose coverage that suits their unique needs.

Customer Testimonials

Real-life stories of individuals who benefited from their Two Wheeler Insurance provide insights into the real value of being insured.

The Role of Insurance in Road Safety

Promoting Responsible Riding

Insurance companies play a crucial role in promoting safe riding habits through awareness campaigns and incentives.

Impact on Accident Rates

Studies show that areas with higher insurance coverage often experience lower accident rates due to increased awareness and adherence to safety guidelines.

The Evolution of Two Wheeler Insurance

Historical Perspective

From its inception to the present day, the journey of Two Wheeler Insurance reflects the changing dynamics of the industry and society.

Technological Advancements

The integration of technology, such as telematics, is shaping the future of Two Wheeler Insurance, making it more personalized and efficient.

Importance of Reading the Fine Print

Understanding Exclusions

Knowing what is not covered in your policy is as important as understanding what is covered. Be aware of exclusions to avoid surprises.

Hidden Clauses

Some policies may have hidden clauses that could affect your coverage. Thoroughly go through the fine print to uncover any hidden terms.

Comparing Insurance Providers

Factors to Consider

When choosing an insurance provider, consider factors like reputation, customer service, and ease of claims processing.

Online Reviews and Ratings

Feedback from other policyholders provides valuable insights. Check online reviews and ratings to gauge the satisfaction levels of existing customers.

Summary

In Summary, Two Wheeler Insurance is not just a legal requirement but a crucial aspect of responsible and secure riding. Understanding the types, factors influencing premiums, and the claims process ensures that you make informed decisions regarding your coverage. Stay safe on the roads, knowing that you have a reliable financial safety net.

Frequently Asked Questions

Is third-party insurance enough for my two-wheeler?

While it’s a legal requirement, comprehensive insurance offers broader coverage for better protection.

How can I save on insurance premiums?

Safe riding, earning a No Claim Bonus (NCB), and installing safety devices are effective ways to reduce premiums.

What documents do I need when filing a claim?

Necessary documents include the claim form, a copy of the registration certificate, and a copy of the driving license.

Are there any hidden costs in Two Wheeler Insurance?

Reading the fine print is crucial to understanding any hidden costs or clauses in your insurance policy.

How do I choose the right coverage for my bike?

Assess your riding habits, the area you live in, and your bike’s value to determine the coverage that suits you best.

Why to choose mandatorygyan ?

1. Hand Holding Support.

2. Help in Selection Right Policy for You

3. Help in Archive Policy Document E-Locker.

4. Call |WhatsApp |Email Support.

5. Instantly Response.

6. Lifelong Relationship Maintain.

7. Free Services.

8. Free E-books.

9. 50 % Course Discount After that You Will Earn.

10. Free Digital Basic Course.

11. Time to Time Policy Related Update to You.

12. Help in Claim Intimation Support.

13. Add in Private Group Member.

14. Will Guide to Group your Life

15. All in One Plate Form for You

16. Our Mission to Insured 1 Lac Lives.

17. In life, You Help someone genuine this kind return to you, it’s my trust…

“Why this offers –Only Intention to secure you and your Family to protect financial security. We Are Here for You. Make mind Clam take Action Now.”

If you have not taken health insurance, then you will face financial problems in future. Still are you thinking? take action now. would request will happy to assist you. don’t worry be free and call back to us and let me help you.

In Hindi: – अगर आपने स्वास्थ्य बीमा नहीं लिया है तो भविष्य में आपको आर्थिक समस्याओं का सामना करना पड़ सकता है। क्या आप अभी भी कार्रवाई करने के बारे में सोच रहे हैं, यदि कोई अन्य समस्या सामने आएगी तो अनुरोध आपकी सहायता करने में प्रसन्न होगा। चिंता न करें, स्वतंत्र रहें और हमें वापस कॉल करें और मुझे आपकी मदद करने दीजिए।

[…] your motorcycle is key, and insurance coverage plays a big role. Comprehensive motorcycle insurance policies offer many coverage options. These include liability protection, collision damage, and uninsured […]